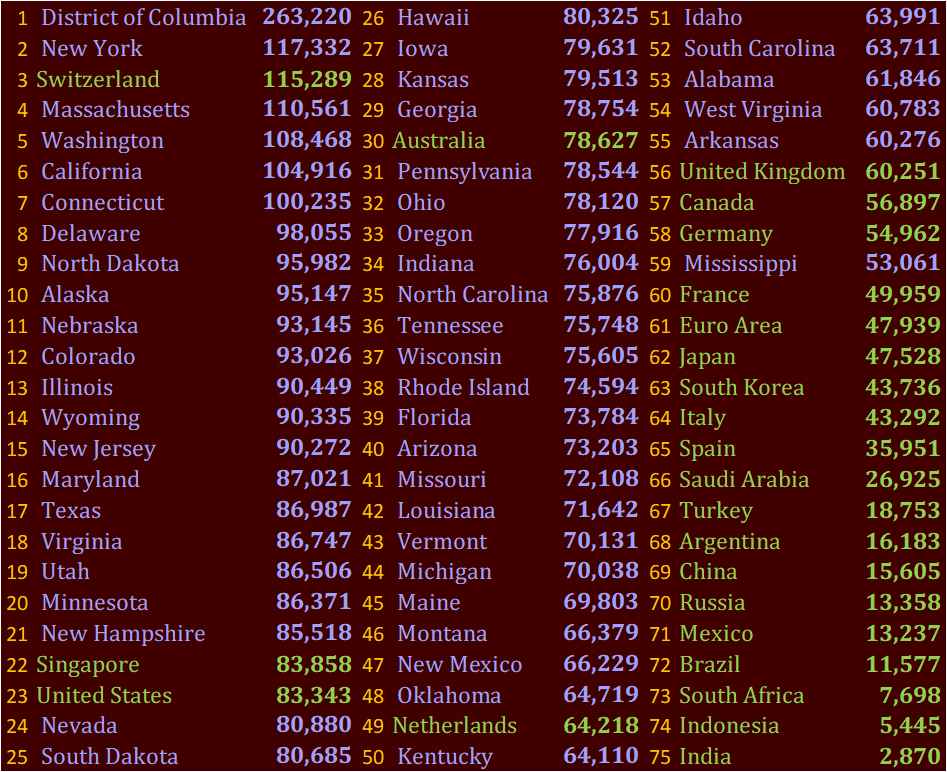

A reader, responding to my article, 'Election Economics', asked, "Will Trump be able to bring prices back down?" I responded to the writer, PJ, "No, but he may be able to raise wages to compensate. I'll write an article to answer in-depth soon." So, this is the article that will answer PJ's question. Reducing inflation means reducing the rate of price increases, but reversing inflation, that is, lowering prices, typically only happens in a recession or depression. President Trump could have some impact if, with the help of Congress, he can reduce or eliminate enough regulations on businesses so that they can lower their operating costs and reduce prices. However, reducing regulations to that extent, while possible, is unprecedented and unlikely. In collaboration with Congress, President Trump has the potential to bolster the economy. By increasing wages and incomes, it's feasible that within a couple of years, the purchasing power could return to pre-Biden levels, countering the effects of inflation. The above brings up a common misunderstanding about Presidential power. In theory, the President's job, as head of the Executive branch of government, is to execute the will of the Congress, the Legislative branch of government. I say, in theory, because U.S. presidents have assumed more power than the framers of the Constitution intended to grant by the more frequent use of executive orders. However, executive orders are not the same as legislation. First, they bypass the legislative process, and second, they do so in a way that Congress cannot simply undo. Congress can remove funding for implementation and take other actions that make carrying them out much more difficult. Only a U.S. President can overturn an existing order and can only do so by issuing an executive order contradicting the original one. So, President Trump can issue executive orders that countermand any orders that negatively affect economic progress. And he can issue new orders to encourage economic growth. What kinds of orders could do that? He could reverse and part orders that place burdens on businesses that unnecessarily cause companies to spend money that they could use to increase workers' salaries. He could issue orders and introduce legislation that simplifies the tax code, thereby reducing business overhead and providing more funds for worker compensation. The national economy is strong, very strong in terms of production, but getting that production translated to employee earnings requires a business environment with limited government regulations. If a company is producing 1000 widgets a day, selling them for 10 dollars each bringing in $10,000, paying stockholders a 10% profit, reducing it to $9,000, and having a fixed overhead of $5000 a day for production space and raw materials, that leaves $4000 a day to pay employees. Suppose the government imposes regulations that cost $1000 a day to implement, such as complicated tax structures that require paying outside lawyers and accountants, reducing the amount available to pay employees. So, the employees end up paying the cost of the regulations snd the taxes. How strong is the economy? Here's a table of the 75 largest producing economic entities measured by per capita GDP. GDP is the total of goods and services produced by the economy and per capita GDP is the individual contribution toward the total. So, it measures how much each person in the economy contributes to production.

Those in green are nations; the others are states in the U.S. As you can see, of the top 20 economic entities in the world, 19 are U.S. states. Only Switzerland and Singapore outperform the U.S. as a whole, and they are also the two economies with the highest rank in freedom from government intervention. However, Singapore has the highest median income in the top 25, $62,364, while Switzerland has the lowest, $39,698. The U.S., while having about the same productivity as Singapore, has a median income of only $37,585; Australia and the Netherlands have the next highest rankings; both ranked more economically free than the U.S. As you see, every U.S. state outproduces all but seven entire nations. This fantastic productivity must translate into employee compensation, which requires scaling back or eliminating government regulations. Government interference prevents American workers from receiving the total amount of the rewards their production deserves. The other issue that President Trump and Congress can address is taxes. Singapore has a tax rate at its median income level of 7%, while the U.S. has a rate of 14.9% plus a median 10.2% state tax rate. That's 25% of earnings at the median income level lost to taxes. If the U.S. tax structure were more like that of Singapore, the ratio of worker income to productivity to income would move dramatically toward higher employee rewards. In his first term, President Trump, with the help of Congress, reduced regulations and taxes, which increased real household incomes by thousands, as shown in the article mentioned earlier, Election Economics. So, while it is unlikely that President Trump can roll back prices, it is possible that with the help of Congress, he can reduce government intrusion and renew or deepen the tax cuts from his previous administration, which would increase employee compensation enough to more than compensate for the effects of inflation. Furthermore, since it is doing so by rewarding productivity, it would not have an inflationary impact like a minimum wage increase. I hope that answers PJ's question, and my thanks to PJ for asking.

If you found this article stimulating, please share it with other folks who might enjoy it. And please share your thoughts below. Dr. Cardell would love to hear from you.

Responses