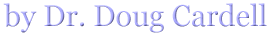

My recent articles have discussed how the American economy has driven wealth creation far beyond any previous period in human history. Here are some of those articles, 'More Pie Please', 'Achievement Economy', 'Does Amazon Deliver', and 'Then & Now Part 3'. The American stock indexes are all at or near record highs and have demonstrated growth far beyond those of any other country. In this article, I want to get personal. I want to show you how you can jump on the gravy train. Below is a graph of the performance of the S&P 500 over the past 50 years. Investing in an S&P index fund allows you to participate in the rise of the S&P without having to invest in each of the 500 individual stocks.

As you can see, the S&P is more than 80 times its value 50 years ago. However, much of that is due to inflation. If we adjust for inflation, the value in 1974, $68.56, would be $418.86 in today's dollars. As of July 3, 2024, the current value is $5537.02, 13 times that of 50 years ago. That's amazing! The other market averages, like the DJIA and NASDAQ, have done similarly well. I'd like to see you take advantage of this in the years ahead. Below is an Excel spreadsheet that can help you plan your financial future. Four inputs are necessary to make the required calculations. You can enter the inputs and the spreadsheet will calculate the results. The first is your annual income. If you are not currently employed, use a reasonable starting salary expectation. If you are an hourly wage earner working 40 hours per week, multiply your hourly rate by 2000 to get your annual rate. It's OK to be optimistic, but try to stay in the realm of reality. It won't be much of a plan if you base it on a fairy tale. The initial value, already in the spreadsheet, of $30000 per year is based on a $15 per hour minimum wage.

The next input is the annual increase rate. In most jobs, you expect salary increases over time. If you investigate, look at earnings charts provided by your employer, and talk to current employees, you can get a pretty good idea of what to expect. The example already entered is 3, which is an expected increase of 3 percent per year. The next input is the Initial Deposit Rate, which is the percentage of income you are willing to invest. I recommend a minimum of ten percent, but the more you deposit, the higher the increase. No pain, no gain. Finally, the last input is the increase in the deposit rate. The logic here is that the more you earn, the more you can afford to contribute. So, as your salary rises, so should your contribution rate. The example shows a rate of one and a half percent per year. That's half the salary increase rate, and half the salary increase rate is a good choice unless you have a reason to do otherwise. Now that you've entered all the data, you can see the results in the table and the graph. It's worth noting that even starting at minimum wage, as our initial example does, one can still retire with over three million dollars in retirement savings. It is essential to point out that inflation will eat up some of these gains, but since your annual income is also increased by inflation, these results should still be a reasonable estimate of reality. This estimate also assumes that the S&P will average about the same returns in the next 50 years as in the last 50. One key takeaway is that in our initial example, about $500,000 in deposits yielded over $3,000,000 in returns. That's $2,500,000 of free money (you do like free money, don't you). Furthermore, you can be satisfied knowing that your investments are improving the economy for everyone. Other investments can perform equally well. Real estate investment trusts (REITs) and art trusts can do just as well and help diversify your portfolio. Being a capitalist is the best way to improve the world for others by investing in companies that create and manufacture all the goods and services for all the people and getting paid for it. Be good to yourself and the world; be a capitalist.

If you found this article stimulating, please share it with other folks who might enjoy it. And please share your thoughts below. Dr. Cardell would love to hear from you.

Responses