The Bubble Tax

by Dr. Doug Cardell

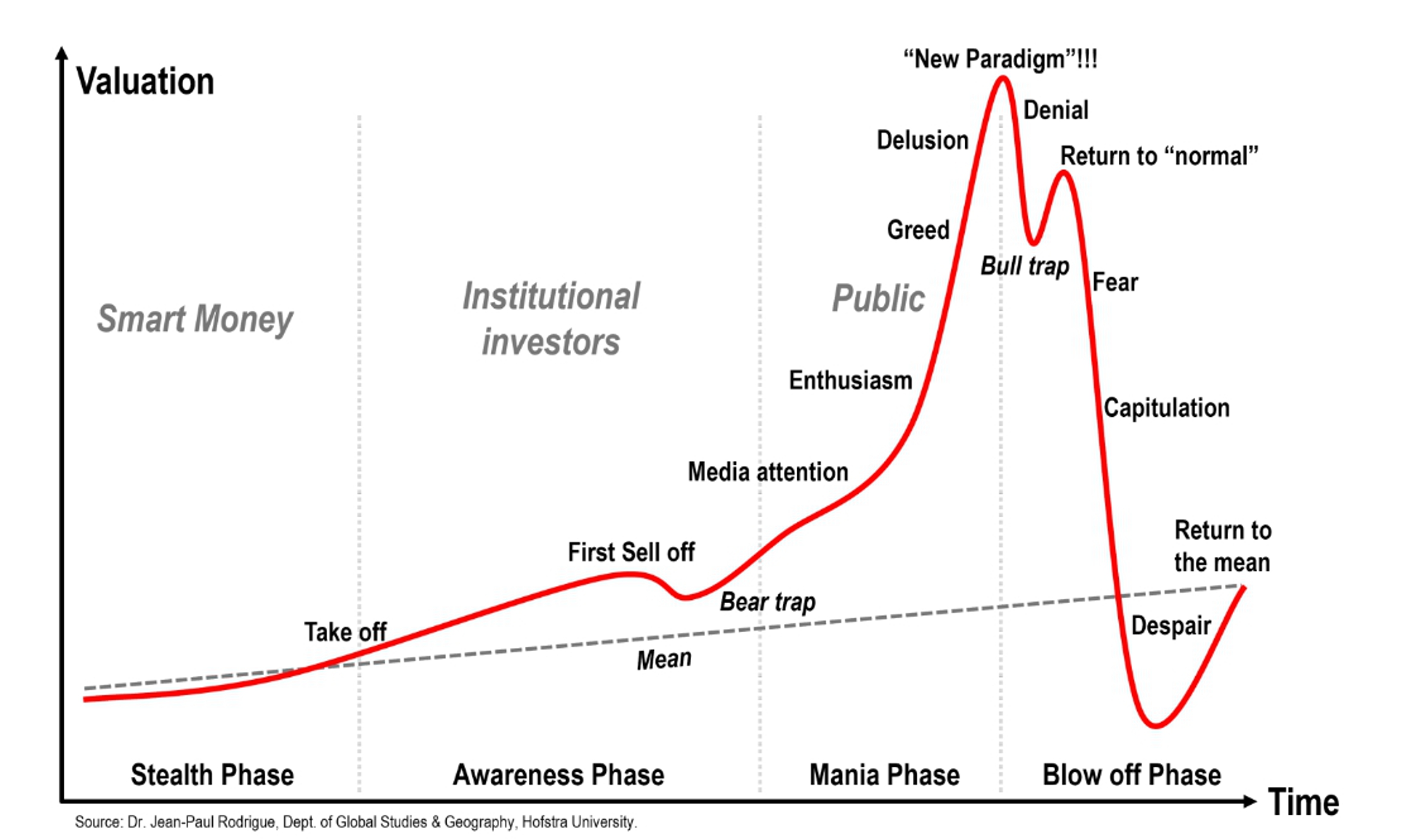

After reading Economic Error, several folks have asked about ways to prevent bubbles from crashing the economy as the 2007-8 housing bubble did. Speculators' flipping' houses caused that bubble and the resulting crash. The homes weren't increasing in value; they weren't 'better.' It was like a Ponzi scheme in which the initiators of the boom made profits, victimizing everyone else. Buying an asset, like a house, intending to resell quickly to make a quick buck causes and worsens booms and busts. Legitimate investing does not cause asset bubbles; speculation does. Investors buying for the long term based on sound economics are essential to a thriving market. Speculation bankrupts most speculators and takes a toll on the economy, hurting millions of innocent bystanders. Greed drives speculation, and since we will never eliminate greed, we must find a solution directly addressing greed. The only way to eliminate the effects of greed is to eliminate the possibility of profiting from that greed. A scaled capital gain tax that favors long-term investment over speculation would be an excellent way to do that. I suggest a new tax law I call the Federal Long-term Investment Protection Tax or F.L.I.P. Tax. This F.L.I.P. tax introduces increased protection for long-term investing and a severe tax penalty for asset 'flipping.' This tax would require reporting any investment asset buy, trade, or sale, including the date of purchase and purchase price of the asset and the date of sale and the asset's selling price. Most transactions of this type already require this sort of record keeping. From these records, the taxman can determine the hold time of the asset and the profit made in the transaction. Then, the gain from the sale, if any, would be taxed on a sliding scale. A formula for this tax might be T = .75^t, where T is the tax levied on the sale and t is the time elapsed between the purchase and the asset's sale.

Flipping an asset after 6 months imposes an 87% tax on the profits. After a year the tax is 75%. After five years it's 24%. After 10 years it's down to 6%. At 20 years it is less than 1%. Under this tax system, holding an asset for less than four years puts the tax rate above the highest marginal rate for ordinary income under U.S. current tax law. Keeping the investment for between six and a half and seven and a half years would be necessary to get to the rates that current tax law allows after one year. After seven and a half years, the rate continues to descend until, at thirty years, it is essentially zero. There are three tangible benefits of this plan:

1) It provides a massive disincentive to 'flip' an asset. This tax would have the effect of dramatically reducing, if not eliminating, speculation. Engaging in a highly leveraged and speculative investment would create an even more significant disincentive since the tax raises the risk-reward ratio beyond acceptable levels.

2) It has the benefit of significantly increasing the rewards for the long-term investor. Rewarding the long-term investor is essential because of its positive effects on the national economy and its guarantee to the investor of greater rewards. It also would benefit the average homeowner by making the sale of a home held for a longer term or by applying the proceeds of sale from one home to another home as is allowed by current tax law, to have the profit from the ultimate sale tax-free.

3) The only way to eliminate market crashes is to eliminate the booms or bubbles. This plan does so. Some might worry that the tax early on is excessive; they might be concerned about the need to sell an asset in an emergency. However, this is not a cause for concern since the principal of the investment remains whole; the investor can get their money back at any point since only the profit is taxed.

The following graph shows how the investment would play out over fifteen years, assuming a seven percent growth rate, compared with that same investment with no tax. After about fifteen years, the tax has essentially no effect on the value. As you can see, the impact of the tax is to reduce profits for speculation and increase earnings for legitimate investing.

You can see in the graph that the asset value is substantially decreased early on but narrows to nothing as time goes on. The F.L.I.P. Tax also has the effect of shifting regulation from monetary policy to fiscal policy. It does so in ways that benefit the economy as a whole and the individual long-term investor. The shift from monetary policy to fiscal policy is more democratic than current regulatory methods because it transfers the governance from the hands of unelected, unresponsive regulators at the Federal Reserve to the people's elected representatives in the House and Senate. This tax is crafted in such a way as to make long-term investing more rewarding and flipping far less attractive. Since it mitigates greedy impulses, it is economically sound and can potentially improve morality by combating greed. In addition, it creates an even greater disincentive to engage in speculative investment based on borrowing or highly leveraged strategies as the risk-reward ratio is raised well beyond reasonable levels. It also has the benefit of dramatically increasing the rewards for those investing in the long term. This advantage to the long-term investor is vital because it produces investor behaviors that positively affect the national economy. Even disregarding the potential for bubbles, speculation is of no economic value since it does not add value as investment does. Another benefit would accrue to the 'average' person who is not actively investing. It would replace current I.R.A.-type rules and essentially eliminate all taxes on retirement funds held for over thirty years. Funds put in at age twenty would be eligible for tax-free withdrawal at age fifty, and so on. The other way it helps the average person is by making the sale of a home held for a longer term to have the profit from the sale tax-free. This benefit would also apply to using the sale proceeds of one house to purchase another home and treating it as a continuation in housing as is allowed by current law. Only 'cashing out' the home's asset value would be subject to tax and, even then, subject to no tax after thirty years. Some might be concerned about how high the tax is early on. So, the FLIP Tax solves the problem of boom and bust cycles and benefits everyone. It keeps speculators from bankrupting themselves and others by creating a bubble that will ultimately burst. It rewards long-term investors for their productive use of funds. It helps the average person by eliminating the tax on their two most used investments: their home and retirement savings. Finally, it benefits the national economy since the additional investment it spurs will promote sound economic growth.

If you found this article stimulating, please share it with other folks who might enjoy it. And please share your thoughts below. Dr. Cardell would love to hear from you.

Responses