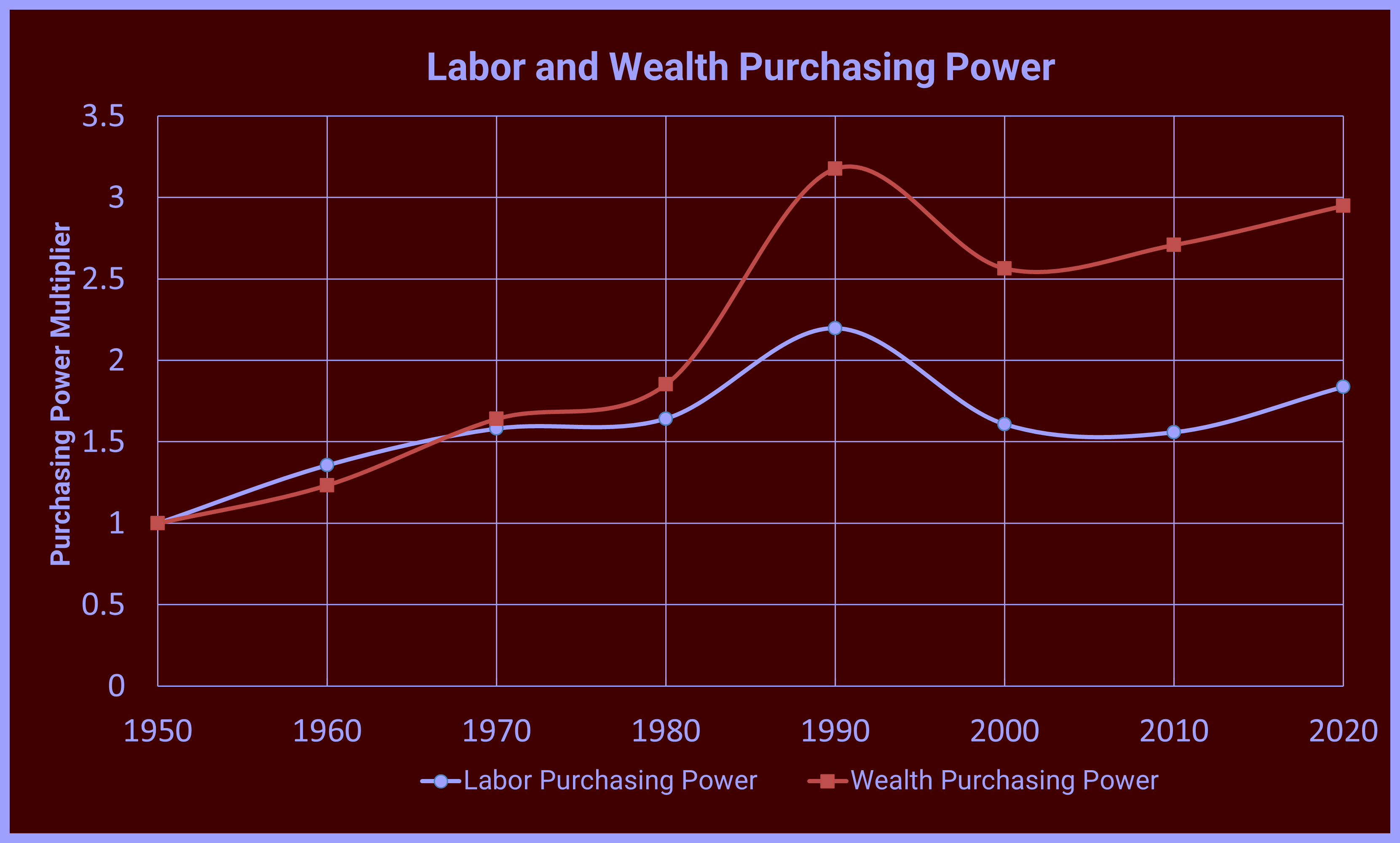

Every day, we read in the news that costs are rising, wages are stagnant, and everyone is suffering. None of this is true! A large part of why many economists and most of the media get it wrong is because they are measuring with the wrong ruler! We focus too much on money, a level of abstraction away from reality. Money is not the reality— it is a medium of exchange—the reality is the exchange. We exchange goods for goods, time for time, and most often, time for goods. Every time you purchase goods, you exchange the time it took you to earn the money you are spending for the goods you buy. The only accurate way to measure how well you, or anyone else, are doing financially is to ignore the money and measure it in time. How much time was spent to purchase this product? Using this measure, Americans are far better off today than in 1950 or 10 years ago. Here's an example of what this means. I've been a musician all my life. In 1964, I bought a Fender Telecaster for $235. Today, you can buy one for $600. Some people look at that and say, see, it's more than twice as much. But let's look at the other side: in 1964, our four-piece band was lucky to make $20-40 for a 4-hour gig. That's $5-10 each. Today, I still perform a couple of times a month, and we get $150-$1000 per person. So, in 1964, paying for that Telecaster took me 188-376 hours; today, it would take 2-16 hours. So, for a musician buying their tools it was between 23 and 94 times more expensive in 1964. As you'll see as we go on, this is not the exception; it's the rule. How is this possible? The value of things changes over time. Since the beginning of capitalism and the Industrial Revolution, the value of labor has been increasing compared to the value of goods. This change means that, like the Telecaster example, the time spent working earns more, and the cost of goods decreases (measured in constant, non-inflated dollars). Using time-cost measurement eliminates factoring in inflation, making it easier to compare like to like. Using time-cost is also true of wealth since wealth is accumulated time-cost and the time-value of money invested. It's worth noting that measured by time-cost, only healthcare and education are more expensive today than in 2000. If you want to learn why, see my previous article, 'Then and Now Part 1'. Looking at the graph below, you can see that labor and wealth purchasing power both increased for the past 70 years except for the doldrums of the nineties. You can see that labor purchasing power has almost doubled while wealth purchasing power has nearly tripled.

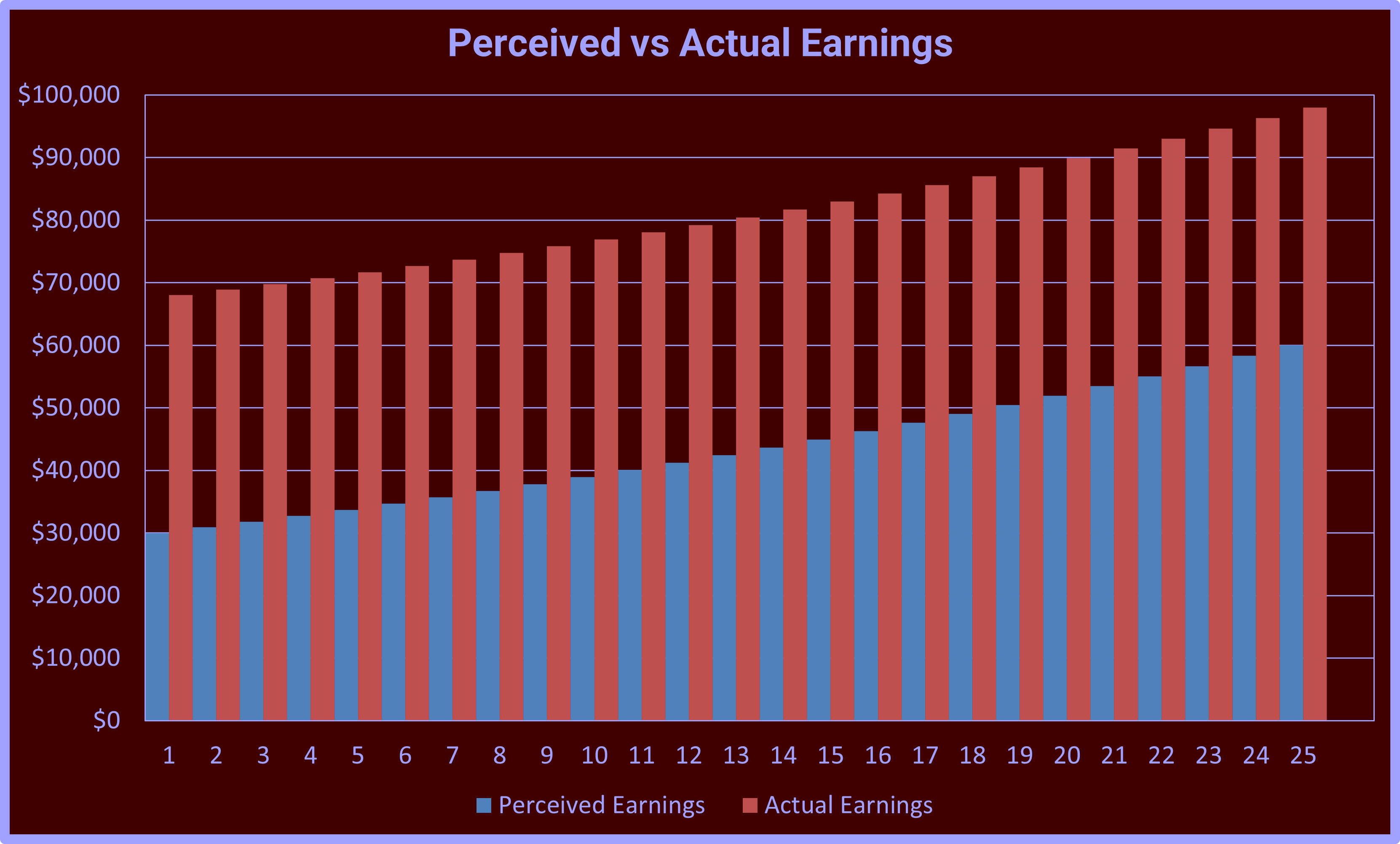

Another factor people tend to overlook is that time earns more than immediate salary. Time working frequently also earns health insurance and a pension. Let's look at someone eighty-five years old, who retired at 65, earning $60,000 yearly. They have a pension of $45,000 per year and healthcare. Their healthcare has covered $50,000 in medical expenses since they began working. The $50,000 in healthcare, and $45000 per year for 20 years is part of their compensation for their time. That's $950,000 in additional income, nearly an extra million dollars. If we divide that by the 25 years they spent with the company, they made an extra $38,000 a year they didn't recognize. While we said their retiring salary was $60,000, it was really $98,000, and since most of their working life was earning less than $60,000, the additional $38,000 per year likely meant they were getting paid more than twice as much as they thought. You can see in the graph below the difference between the perceived income and the actual income.

Adopting the time-cost yardstick in your life and understanding your actual income is a crucial step in sound financial planning. It's also a reassuring revelation that our economic situation is improving despite the whining of the naysayers. Armed with this knowledge, we can confidently navigate the financial landscape, knowing that things are, in fact, getting better.

If you found this article stimulating, please share it with other folks who might enjoy it. And please share your thoughts below. Dr. Cardell would love to hear from you.

Responses