Welcome! If you're confused about economics, you've come to the right place. Reading the news regarding the economy is often biased and inaccurate. This lack of reliability happens because many economic writers base their economic arguments and policy proposals on ideology and ignorance rather than following the evidence. This website is committed to providing you with reliable economic insights, highlighting the evidence and setting the record straight. His articles, listed on the menu, delve into fundamental economic truths that are often overlooked due to personal agendas, as well as current hot-button issues. If you are new to this site, it might help to read some of the earlier articles at the bottom of the menu since they contain helpful background. Every day, we will feature one of these articles below. What's more, they all have a comments section, and Dr. Cardell is eager to hear your thoughts about the articles. This interactive feature encourages lively discussions and diverse perspectives. Brief Bio: Dr. Doug Cardell is an economist and an economic policy expert with a unique perspective. His diverse career includes roles as an aide to a Member of Congress, a corporate CEO, an award-winning educator, a consultant to the Arizona Department of Education, and a Professor of Mathematics. His expertise spans economics, economic policy, mathematical modeling, and system dynamics modeling. He holds advanced degrees and certificates from the University of Arizona, the Massachusetts Institute of Technology, and the University of Phoenix, as well as a PhD in Economic Policy from Liberty University. His comprehensive understanding of economics, both from a theoretical and practical standpoint, his proficiency in mathematics and modeling, and his success as an educator make him uniquely qualified to explain economics and evaluate economic systems and ideas.

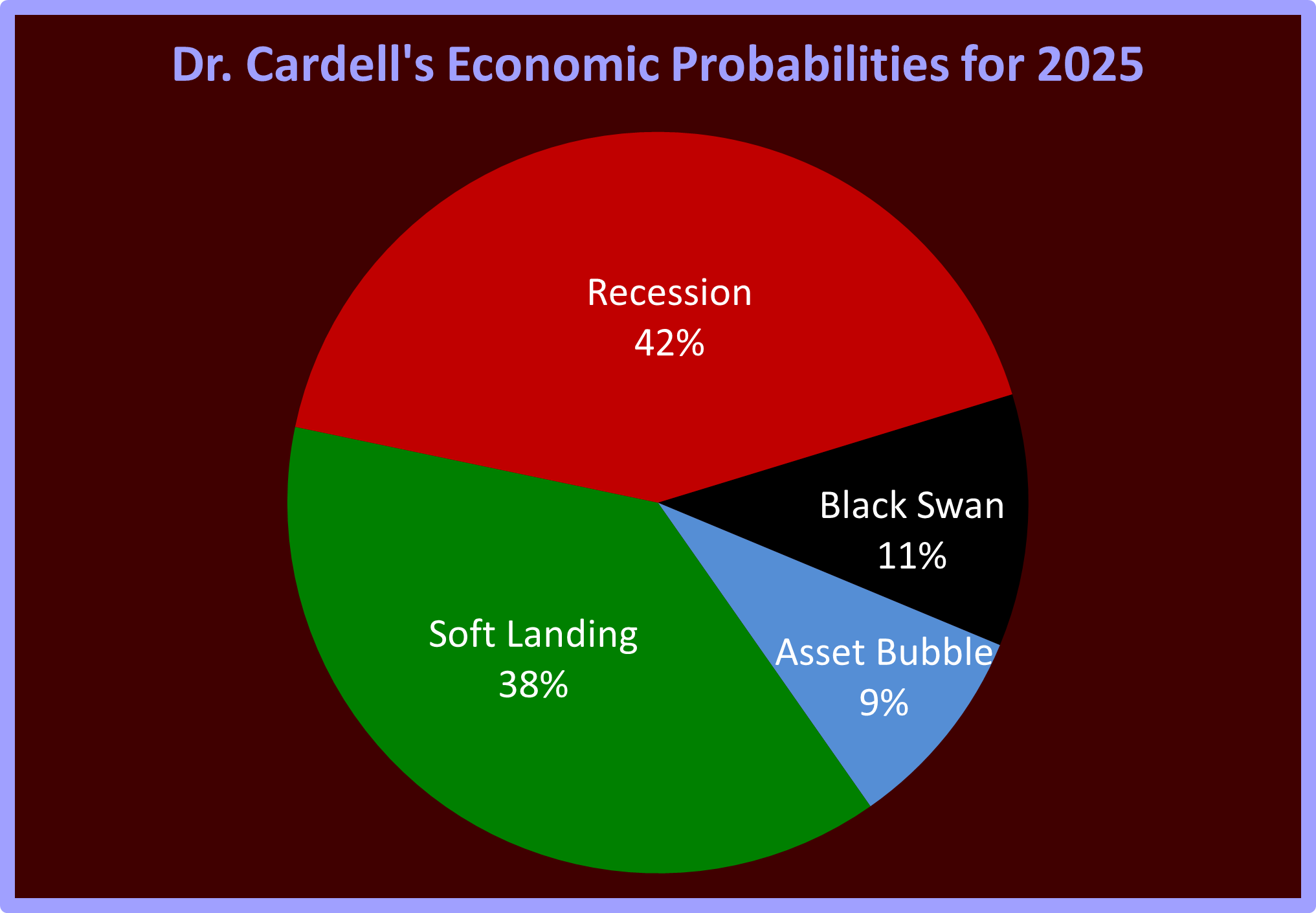

What's in store for 2025? As always, when I share what my models indicate, I must explain what many economists and virtually none of the media will tell you. ALL MODELS ARE WRONG. Some of what follows will be familiar if you've read my article: 'Model Behavior' Yes, I've told you that before, but it deserves repeating. All models are a simplification of reality. We must simplify reality because most realities are too complicated to understand. My go-to explanation is a doll. If you've read my explanation before, forgive me, but it's the best one I've got, so I'll use it to benefit those who haven't read it yet. A doll is a model of a person. It's okay for many purposes, but understanding how the human body functions is not one of them. Too often, people overextend a model's reach. They open the doll, look inside, and conclude that people are full of cotton. People think a perfect model will lead to perfect results. However, a "perfect" model is no longer a model but an unsimplified copy. Useless! Some models attempt to model chaotic systems, like the weather. You've probably heard of the butterfly effect. It describes the possibility that a butterfly flapping its wings in Brazil could precipitate a tornado in Texas. No model will ever make sound day-to-day weather forecasts beyond a week or two. This uncertainty is because chaotic systems have vast numbers of independent entities affected by local variables, and tiny changes in even one can have an outsized effect. In the case of the weather, these are air molecules. In the economy, the autonomous entities are producers and consumers. You might be the butterfly. If you buy an additional six-pack of Pepsi next month, that may be the purchase that triggers an increase in the grocer's next order from their supplier. But since your purchase was an extra six-pack you don't usually buy, it might result in a supply excess at your grocers next month, which could trigger a smaller reorder, resulting in scarcity the following month. The oscillations often grow with each repetition and cause severe distortions in the supply chain—think toilet paper during COVID-19. Neither you nor the butterfly can do this alone, but you or the butterfly could be the last straw that tips the system. So, could your buying a six-pack of Pepsi in Catalina precipitate a recession in Poland? Yes, that's the nature of chaos. Two other factors create economic turmoil: asset bubbles, like the 2007 housing bubble, and rare events, like the recent pandemic. Given those cautions, we can consider the results indicated by my models. They suggest an 11% chance of a black swan upsetting the apple cart. The chances of a black swan event always rise when a substantial government change occurs. My model indicates a 9% chance of an asset bubble causing severe economic distortion. Presently, no concerning asset bubbles are forming. The probability of a 'soft landing' with no recession is 38%, and a recession's likelihood is 42%.

Everyone asks me about the effects of Trump's tariffs. While it's too early to tell, I am comfortable saying that the concern is overblown. While I haven't read his book, his negotiating style is apparent. While most negotiators start at the highest realistic price they can expect to get, Trump starts with the outlandish. He doesn't say, "the US is concerned about Russian and Chinese increasing influence in the arctic circle and would like to cooperate with Greenland to counter this influence". No, Trump says, "I'm going to buy Greenland." Similarly, Trump will not invade Panama nor take over Gaza. How Trump's tariffs eventually shake out will likely be far less impactful than most folks fear. Trump inherited one of the worst economies in modern history. Turning it around will take some heavy lifting. Many economic indicators will worsen until policy changes have time to achieve their goals. However, the economy's underlying fundamentals are strong, giving reason for optimism. Are they strong enough to prevent a recession? Maybe not, but the good news is that if a downturn occurs, it will likely be mild and short. You've read what I had to say about models, but here's more fodder. The Atlanta Federal Reserve's GDPNow model projects negative growth in Q1. The New York Fed's Nowcast is much more optimistic, estimating Q1 growth at over 2%. Two consecutive negative quarters of economic growth define a recession. The Atlanta Fed predicts the first of the two months, while the New York Fed says "no worries" a bit slow but OK. Who's right? Yours truly or one of the Feds? We'll have to wait and see.

If you found this article stimulating, please share it with other folks who might enjoy it. And please share your thoughts below. Dr. Cardell would love to hear from you.

Responses